Northwest Freeway Municipal Utility District (Northwest Freeway MUD) has been responsible for providing water, sanitary sewer, infrastructure, and services for nearly 48 years. Northwest Freeway MUD serves approximately 4100 residents in approximately 1183 homes within the Ranch Country, Ranch Country Estates and Cypresswood Trails neighborhoods. Northwest Freeway MUD currently operates and maintains two (2) water plants with onsite water wells, one (1) wastewater treatment plant, and one (1) sanitary sewer lift station. The current infrastructure is connected by 10.9 miles of water lines, 13.4 miles of sanitary sewer lines, 1.7 miles of drainage ditches, and 6.8 miles of storm sewer lines.

On November 3rd, residents of the District will be asked to vote in an election to determine whether the MUD will be authorized to issue bonds in several increments over time, as needed, to fund the maintenance, rehabilitation and upgrade of portions of the MUD's Water, Sewer, and Drainage infrastructure as it ages.

Aging Infrastructure

As the MUD’s Water, Sewage and Drainage (WS&D) continues to age, it requires regular maintenance, rehabilitation and in some cases, replacement as part of its lifecycle. In order to serve our communities properly, the MUD needs to maintain, repair, and replace infrastructure.

As a part of the Bond Election Report submitted by the District engineer, the MUD has identified some of the projects that will necessary over the next 5-10 years to maintain, replace, or upgrade the aging infrastructure owned and operated by the District.

Long Term Plan

Northwest Freeway MUD’s Board of Directors has worked with its engineering and financial advisors to develop a long-term plan to address the needs of the District over the coming years.

Additionally, to the needed maintenance, rehabilitation, and possible replacement to District infrastructure, a portion od this authorization will be utilized to pay for infrastructure that will service the 108 – acre annexation tract of land to be developed. The Developer reimbursement for these infrastructure costs is currently expected to be approximately $8,960,00 including non-construction, “soft” cost of issuance.

Developer reimbursements such as this are typically not paid until the taxable property valuation on the ground pays for itself, so bonds sold to fund this infrastructure would not increase the tax rate or burden on existing residents of Northwest Freeway MUD, and will add more property owners contributing to the overall tax base and revenue collection of the District.

The District’s Engineer has estimated the combined amount of bonds required to fund the above items, including inflation and net of the District’s existing authorization, to be $18,155,000.

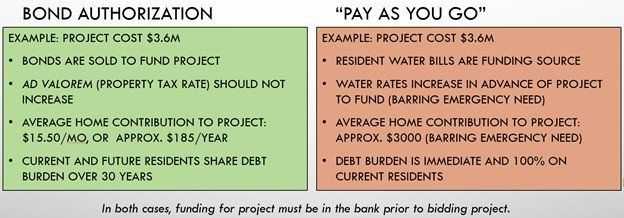

Bond Financing vs “Pay as You Go” with Cash

The two primary options available to the MUD for funding are (1) to spread the costs of the projects out over time through the issuance of bonds or (2) to pay for the projects with cash using a "pay as you go" approach requiring substantial increases in water and sewer bills. The District must have funds in hand before it can proceed with a required project. Funding projects with maintenance taxes or water and sewer rates would likely require an increase in rates in the short-term to collect the required funds. This method places the financial burden for long term projects on current residents and could create delays and increase costs for the completion of large projects.

Authorizing the District to issue bonds would allow the Board to spread the costs of the necessary projects over numerous years and avoid the increases in maintenance tax rates and/or water and sanitary sewer rates typically required by a "pay as you go" approach. This method spreads the cost for these projects among both current and future residents and businesses in the District and enables the District to complete necessary projects quickly.

An Example

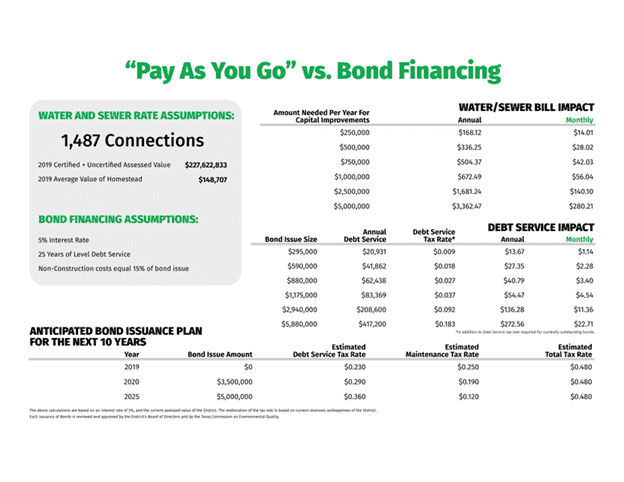

To explain in more detail, take the first example in the chart of a hypothetical $1,000,000 WS&D capital improvement project.

The first option available to the MUD is to finance the project through bonds, which uses a financing model similar to what residents may have for their homes. Financing WS&D improvements using bonds, or a long-term loan, has the effect of spreading the cost over the useful life of such improvements. This allows the cost for the necessary work to be spread out over a longer period of time and to be paid for by both current and future residents of the MUD. Assuming the financing terms included in the above chart, the bonds required to fund the $1,000,000 project would account for $54.47 of the property taxes for each residence in the MUD, or about $4.54 per month, for bonds sold at a 5% interest rate.

If the MUD is not able to issue bonds to spread the costs of this $1,000,000 project over time, the MUD would need to fund the project with cash through increased water bills. Under this option, Northwest Freeway residents would pay an additional $672.49 annually in their water and sewer bills, or about $56.04 each month. If the MUD is required to utilize this cash payment option for a project, it must have the entire project cost on deposit before it can award a construction contract for the project.

As the size of the required project grows, the dollar amounts required under each financing model grow proportionately. A $5,000,000 WS&D capital improvement project financed over time with bonds would account for $272.56 of the property taxes annually for each residence in the MUD, or about $22.71 each month. If paid for with cash using a "pay as you go" approach, this same $5,000,000 project would require an additional $3,362.47 annually in the water and sewer bills of residents, or about $280.21 each month.

Impact on the MUD’s Total Tax Rate

Over the last 8 years, Northwest Freeway MUD has reduced the District’s total tax rate b y more than 45.7%, going from $1.29/$100 per accessed value in 2012 to $0.70/&100 per assessed value in 2020. As a result of prudent financial management, the District has earned a “BBB+” underlying rating from Standards & Poor’s.

If the requested bonds are authorized, the Board does not anticipate a debt service tax rate increase in the next 10 years as a result of these bonds.

As residents inform themselves regarding the bond election, they are encouraged to reach out to the District for any clarifications they might need by using the Contact Us form on the District’s website.

Did you find this article informative? Help keep your neighbors in the know by clicking the share button below to post to your favorite social media channels.